The future of direct selling in India is evolving rapidly. Economic reforms (like Make in India and Atmanirbhar Bharat) and a push toward a $5 trillion economy are creating a pro-business climate. Consumer preferences are also shifting: people increasingly value entrepreneurship, flexibility, and personal connections in buying. This social shift is fueling interest in direct selling and network marketing as viable careers.

By 2026 and beyond, factors like greater smartphone penetration, social media reach, and a young demographic will accelerate this change. The direct selling future in India 2026 and beyond looks tech-driven, data-aware, and focused on wellness and personalization. In this landscape, direct selling is maturing into a mainstream distribution channel and career path.

What is Direct Selling in India

Direct selling is a distribution model in which products are sold directly to consumers without traditional retail outlets. There are two types of direct selling; single-level marketing and multi-level marketing. Independent distributors market and deliver products through personal networks, in-home demonstrations, and increasingly through digital platforms. Widely used in sectors such as wellness, personal care, and nutrition, direct selling enables individuals to earn income through product sales, and in some cases, through team-based distribution structures.

From a legal perspective, direct selling is permitted in India as long as companies follow regulations. The government’s 2021 Direct Selling Rules (under the Consumer Protection Act) define the business model and ban pyramid or money-circulation schemes. Companies must register with authorities, provide clear product and price details, offer refunds or repurchases on unsold stock, and avoid upfront joining fees. These rules aim to protect sellers and consumers. When such guidelines are followed, direct selling is recognized by authorities as a legitimate business activity.

Evolution of the Direct Selling Industry in India

Direct selling in India has grown from a niche sideline into a significant economic sector. In the early 2000s, global network marketing companies such as Amway, Oriflame, and the Indian firm Modicare began operations in India, attracting entrepreneurs seeking flexible incomes. The model took off in urban centers and gradually spread to smaller towns as consumers warmed to buying through trusted personal networks. By the 2010s, direct selling was a well-known sales channel in India’s consumer market.

Policymakers took note of this expansion. In 2016, the central government issued model Direct Selling Guidelines for states, and several state governments passed their own rules. The year 2021 was a turning point: India introduced official Direct Selling Rules under the Consumer Protection Act. These rules formally defined the business model, banned pyramid schemes, and required companies to register and disclose their terms. The new legal framework provided clarity and boosted confidence in the industry.

Meanwhile, consumer behavior and technology were shifting. The rise of smartphones and social media enabled a hybrid selling approach. Distributors now use WhatsApp, YouTube, and other online platforms to complement in-person demos. The COVID-19 pandemic briefly slowed offline sales but also accelerated digital adoption. By 2023, industry turnover had recovered to around ₹21,000 crore, reflecting steady resilience. Today, direct selling in India blends personal outreach with e-commerce channels, setting the stage for future growth.

Market Growth & Future Outlook (2025–2030)

India’s direct selling sector has demonstrated consistent growth. By FY 2022–23, industry turnover was around ₹21,000–22,000 crore (about US$2.5–3 billion), implying high single-digit annual expansion in recent years. Analysts expect this momentum to continue. Forecasts suggest the market could exceed US$20 billion by 2030, growing at roughly a 9–10% annual rate. In practical terms, this means the direct selling future in India 2030 may involve roughly doubling the current market size.

Even in the nearer term, the outlook is positive. Reports on the future of direct selling industry in India 2025 often predict significant expansion as the model goes mainstream. Factors like a rising middle class, deeper internet and digital payments penetration, and entrepreneurship support programs point to more sellers and higher sales volumes. This is especially true in Tier-2 and Tier-3 towns, where improving logistics and connectivity enable direct sellers to reach new customers.

Overall, the industry is poised to outpace broader retail growth. By 2026, the direct selling future in India 2026 is expected to feature widespread use of tech tools (AI, mobile apps, virtual training) for sales and marketing. If current trends persist, by 2030 direct selling in India should be much larger and more professionalized—establishing it as a key channel for consumer goods and livelihoods.

Key Trends Shaping the Direct Selling Future

As the direct selling industry supported by lifestyle shifts, digital infrastructure, and regulatory alignment, the direct selling industry in India is entering a phase of steady, long-term expansion beyond 2025. The following trends explain the underlying forces driving this growth.

Digital-First Distribution Models

Direct selling is increasingly moving online, with distributors using social commerce, messaging apps, and e-commerce tools to reach wider audiences beyond traditional in-person networks.

Growing Consumer Awareness and Trust Expectations

Indian consumers are becoming more informed, placing greater emphasis on product quality, transparent pricing, and ethical business practices.

Rise of Wellness, Nutrition, and Personal Care Products

Health-conscious lifestyles are driving sustained demand in categories where direct selling has traditionally been strong.

Upskilling and Training Focus

Success in direct selling increasingly depends on training, communication skills, and digital literacy rather than aggressive recruitment.

Youth and Work-Life Flexibility Attraction

Direct selling appeals to India’s large young workforce seeking flexible and entrepreneurial income opportunities. Low barriers to entry and the ability to work independently make this model attractive as a side hustle or primary career path, especially among students and early-stage professionals.

Stay Ahead of Industry Trends — Power Your Network with Advanced, AI-Enabled MLM Software

Role of Technology & MLM Software in Future Growth

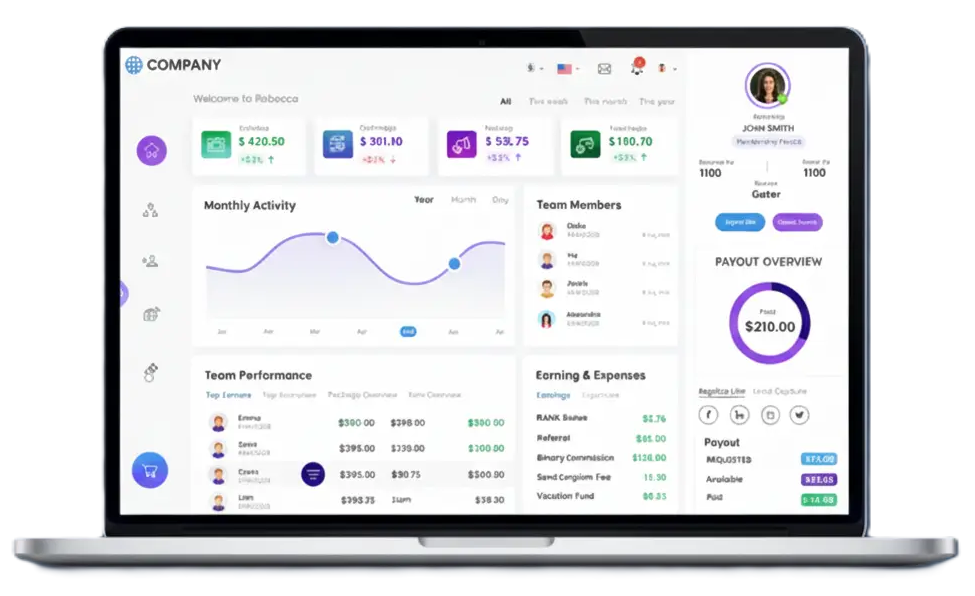

Technology is transforming how Indian direct selling operates. Today’s distributors use smartphones and social media to reach customers far beyond their immediate circle. According to industry surveys, 71% of buyers discover products via social media and 70% via direct-selling companies’ websites or apps. This means future success depends heavily on digital tools. Companies are investing in mobile apps for distributor training and ordering, CRM systems to track sales and incentives, and e-commerce modules (where permitted) for safe fulfillment. AI and data analytics are beginning to play a role: for example, predictive tools can help companies identify trending products and forecast sales in new regions.

In short, technology is blurring the lines between “network marketing” and mainstream e-commerce. The future of direct selling and MLM in India will feature an omnichannel approach: personal touchpoints (online video calls, webinars, live chats) combined with enterprise-grade digital infrastructure behind the scenes. Companies that integrate robust MLM software, e-commerce logistics, and social media marketing will gain a competitive edge.

Challenges Facing Direct Selling Companies

As direct selling continues to gain momentum in India, the real challenge lies not in entering the market, but in maintaining trust and relevance amid evolving consumer and regulatory expectations. Below are some of the common challenges the industry must address.

Regulatory Complexity

While clearer rules bring legitimacy, they also add compliance tasks. Firms must navigate both national regulations and varying state policies. Meeting all registration, reporting, and auditing requirements can strain resources, especially for smaller companies.

Logistics & Operations

Fulfilling home delivery orders nationwide is challenging. Companies must coordinate inventory, shipping, and returns for individual customers. Any lapse (like delayed delivery) can harm customer trust, so an efficient supply chain is critical.

Market Saturation and Competition

Popular categories (like basic cosmetics or supplements) can become crowded. Direct selling firms compete with each other and with e-commerce/retail brands. Maintaining unique, high-quality products is essential to stand out.

Public Perception and Trust

Direct selling still faces skepticism, often conflated with illegal pyramid schemes. Companies must demonstrate real product value and ethical practices to build credibility. Overcoming negative perceptions remains an ongoing effort.

Distributor Turnover

High dropout rates are common. Many new sellers leave within the first year, often because the sales effort is greater than expected. Companies must invest in training and motivation, or they risk turnover that stalls growth.

Adapting Technologies

Although technology offers tools, some sellers struggle with new digital systems. Older or rural distributors may need extra support to adopt mobile apps or online sales strategies. This gap can slow a company’s digital transformation.

What a Future-Ready Direct Selling Company Looks Like

As the direct selling industry in India enters a more mature phase, innovation and digital transformation are redefining how growth is achieved. These shifts are building a stronger, more transparent ecosystem that is increasingly accessible and prepared for the future. A company prepared for the coming era of direct selling in India would typically have:

Digital-First Mindset

Mobile apps, automated commission systems, and online ordering platforms to serve distributors quickly. Such firms use data analytics to forecast trends, personalize marketing, and streamline operations.

Transparent Practices

Clear compensation and buyback policies, honest product claims, and a strong grievance mechanism. Future-ready firms comply with regulations and openly share earnings guidelines, building trust among sellers and customers.

Strong Product Portfolio

Focused on high-demand categories (wellness, beauty, nutrition, etc.) with proven quality. Certification (FSSAI, organic, ISO) and continuous product innovation help retain customer interest as needs evolve.

Strong Distributor Support

Future-ready firms will prioritize distributor success. This means robust training academies (online and offline), mentorship programs, and performance incentive plans. They will also leverage data: for example, analytics to recommend target markets to distributors or personalized coaching to improve weak links.

Compliance Infrastructure

These companies will have internal compliance teams and legal counsel to navigate changing rules. They will implement strict Know-Your-Customer (KYC) checks for recruits, maintain detailed financial records, and be ready for audits. Essentially, they will treat the business with the same discipline as public companies in terms of governance.

Social and Environmental Responsibility

While still early, we expect leading firms to emphasize sustainability – using eco-friendly packaging or sourcing natural ingredients. Building a positive social image (for instance, by promoting women’s entrepreneurship or supporting health/wellness causes) can strengthen trust.

In summary, a future-ready direct selling company in India will blend cutting-edge technology with integrity and strong product differentiation. Such companies will not act like traditional MLM “fly-by-night” outfits; instead, they will operate as professionally managed businesses geared for longevity.

Opportunities for the Direct Selling Business in India by 2026

A report by Grand View Research forecasts that The direct selling market in India is expected to reach a projected revenue of US$ 21,666.8 million by 2030. A compound annual growth rate of 9.7% is expected of India direct selling market from 2025 to 2030. For individuals and small entrepreneurs, the post-2025 direct selling landscape offers several opportunities:

Flexible Income Source

Direct selling allows individuals to earn on their own schedule. This flexibility makes it attractive for students, homemakers, and anyone seeking part-time or full-time work.

Job Creation

Direct selling is predicted to directly employ 2.5 million individuals in manufacturing by 2026, with every INR 0.1 million of output generating around 0.4 jobs.

Skill Development

Distributors develop entrepreneurial and communication skills through training and mentorship. Sales and marketing experience gained in direct selling can benefit them even outside the industry.

Low Investment, Low Risk

Starting a direct selling business typically requires only a small initial product purchase. There are no franchise fees, and companies usually offer buy-back guarantees on unsold inventory, reducing financial risk.

Growing Market Demand

India’s booming middle class and health trends mean high demand for wellness and personal care products. Entrepreneurs can tap into these fast-growing segments, including new niches like organic foods or fitness devices.

Technology Leverage

Technology has democratized marketing. Distributors use social media and messaging apps to reach customers nationwide, so even people in remote areas can build a customer base.

In sum, for motivated individuals, the direct selling industry in India remains a viable avenue for supplemental or full-time entrepreneurship. Increased product diversity and better technology support will only enhance these opportunities after 2025.

Conclusion

Overall, the direct selling future in india 2025 appears solidly positive. With clear regulatory backing and continuing consumer demand, the sector is expected to remain a stable contributor to the economy. In the long term (looking toward 2030 and beyond), the industry could become even more mainstream – complementing retail and e-commerce rather than competing with them. With half of India’s population under age 25 and millions of households still unserved by modern retail, direct selling is well-positioned to scale further and tap new markets. Most analysts agree that as long as companies innovate responsibly and follow best practices, this growth path will continue—empowering millions of entrepreneurs and complementing traditional retail in India’s economy.

Frequently Asked Questions

What is the future of direct selling in India?

The future of direct selling in India appears strong, supported by digital adoption, regulatory clarity, and rising demand for personalized products. Post-2025, growth is expected across wellness, beauty, and social commerce-driven channels.

Is direct selling legal in India?

Yes, direct selling is legal in India when companies comply with the Consumer Protection (Direct Selling) Rules, 2021. These rules recognize genuine product-based models and prohibit pyramid and money circulation schemes.

What is the future of MLM in India after 2025?

The future of MLM in India after 2025 will depend on compliance and technology adoption. The future of MLM business in India 2025 points toward professional, digital-first, and regulation-aligned network marketing models.

Who is no 1 direct selling company in India?

There is no single official ranking, but Amway is often cited as the largest by revenue. Other top direct selling companies in India include Avon, Oriflame, Modicare, Vestige, and Herbalife.

Which is the no. 1 industry in India in 2025?

Technology and digital services are expected to dominate India’s economy in 2025. Within direct selling, wellness, nutrition, and personal care remain the strongest and fastest-growing industry segments.

Is network marketing growing in India?

Yes, network marketing is growing in India, driven by increased digital reach, youth participation, and expansion into Tier-2 and Tier-3 cities. Industry reports show steady year-on-year growth in distributors and revenue.

Does direct selling have a future after 2025?

direct selling future in india 2025, supported by legal recognition, evolving consumer behavior, and digital tools. Ethical, transparent, and product-driven companies are likely to sustain long-term growth.

Which is the best direct selling company in India?

The best direct selling company in India varies by individual goals. Companies with strong compliance, quality products, transparent compensation plans, and long operating histories are generally considered industry leaders.

Is direct selling a sustainable business model in India?

Direct selling is considered sustainable in India when it focuses on genuine products, customer value, and compliance. Digital integration and ethical practices further strengthen long-term viability.

Can direct selling create long-term income opportunities?

Direct selling can offer long-term income opportunities for individuals who focus on consistent sales, skill development, and ethical team building. Income outcomes depend on effort, market demand, and company structure.

Boost profits 10x times with MLMTrees MLM Software.

About The Author

The author has several years of experience in network marketing and direct selling industry. He writes with a practical approach, focusing on how multi-level marketing systems work in real business scenarios and how marketers can build stable and scalable networks over time. The author also takes a keen interest in productivity and time management, exploring how professionals can work more efficiently while managing and growing their businesses.

Share this article

RELATED POSTS